Content

However, no deduction can be taken by the contributor and the basis of property contributed as a nontaxable CIAC is zero. TaxSlayer traces its roots in tax preparation to 1965. It started offering tax software to professional tax preparers in 1991 and launched its consumer-facing do-it-yourself tax software business in 1998. With TaxSlayer, you can do your taxes online or with the TaxSlayer mobile app.

Download option requires a free online Intuit account. Product activation requires internet connectivity. Walks you through all your deductible business expenses from vehicles and supplies to advertising and travel. Get the guidance you need to easily enter your business expenses, no matter how you track them. TurboTax customers—we’ve started your estimate. Searches 500 tax deductions to get you every dollar you deserve.

TaxSlayer

Which means you subtract out the employer portion of payroll tax. The S Corp can reimburse you for expenses in so much as the car was used for work travel . As far as a lease, I guess it comes down to what the lease says, but if it isn’t reasonable the IRS could have a problem with it. But no, an S Corp certainly can’t deduct depreciation for a car it is leasing.

- Schedule B is spread over page 2 and the first part of Page 3.

- Ohio taxes income from business sources and nonbusiness sources differently on its individual income tax return .

- However, we may receive compensation when you click on links to products or services offered by our partners.

- DOR will then review the PTE’s 2021 return and confirm that the PTE did not elect to pay the 63D Excise and did not purport to pass on any 63D Excise credit to members on its Schedule K-1s.

Depending on the software you choose, you may be able to file self-employed taxes with a Schedule C or more complex taxes for a partnership or corporation. While personal tax preparation software focuses only on Form 1040 in most cases, small business tax software has the ability to complete taxes for businesses of all sorts. TurboTax Audit Support Guarantee – Business Returns.

Easy Breezy Beautiful; TurboTax

Massachusetts joins several other states in enacting an entity-level excise that responds to the SALT cap. The law will expire if the federal SALT deduction limitation expires or is repealed. Additionally, decoupling from certain federal provisions may have other effects on the calculation of Georgia taxable income. Adjustments for the items listed below should be added or subtracted on your Georgia income tax form, as appropriate. Tax professionals often have a detailed understanding of tax laws and can offer money-saving advice. However, behind the scenes, accountants use similar tax software to what you use when doing it yourself, so you certainly don’t have to pay extra for a professional preparer.

- Effortlessly compute loan payments or the future value of savings deposits, then print amortization and accumulation schedules.

- But even if not, if you have done your books well, this becomes very simple to fill out.

- All together this probably takes me 1/2 to 3/4 of a day once the books are done.

- Ohio Virtual Tax Academy- Click the « Individual Income Tax » link to view presentations on business income and the Business Income Deduction.

- If you are unable to deduct all of your S-Corporation losses against your income for tax purposes, then you can suspend all or a portion of the loss.

By clicking « TRY IT », I agree to receive newsletters and promotions from Money and its partners. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below. There is also a $19.95 e-filing fee for each individual and business state return.

Is Form 63D-ELT required to be filed electronically?

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. If you have serious doubts or questions about what your small business can write off, it may be worthwhile to pay for an upgrade to a version of a tax program where you can access expert advice. The software program does a good job of walking you through complex tax situations. If you think you’ll need extra help, you can upgrade to Online Assist, which allows you to do your taxes on any device with unlimited, on-demand help from a tax pro.

Keep in mind, however, that it depends a lot on your individual filing situation, your withholdings and your tax bracket. As good as many software programs are, a human expert is often the way to go. By guiding turbotax for s-corp 2020 you through the process and double-checking to make sure you’ve filled out all of the necessary tax forms for your filing status and situation. TurboTax by Intuit is our front-runner for good reason.

Let our experts help or even do your business taxes for you.

She has owned a bookkeeping and payroll service that specializes in small business, for over twenty years. If you’re able to navigate through your Schedule M-1, the next step is to dig into your Accumulated Adjustments Account on Schedule M-2. Accumulated Adjustments is hard to explain, and would be a good subject for a completely different article. In short, it has to do with money that your business has accumulated which has not yet been assigned to be used for any particular purpose. Use the following vendors to file returns electronically. Vendors who want to substitute or replicate a City of Philadelphia tax form should reference the Department of Revenue’s Tax return design specifications.

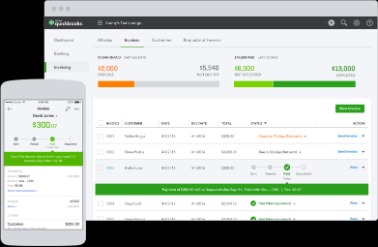

TaxAct allows you to enter multiple copies of many forms. TaxAct Alerts meticulously inspects your return for errors, omissions, and valuable tax-saving opportunities you may have missed. TaxAct’s list of book to tax differences helps reconcile book income for completing Schedule M-1. Select all that apply to find reviewers similar to you. Import your QuickBooks Desktop income and expense accounts and they are classified for you.